News

Whitepaper - Ultra Efficient Fulfilment

By James MacAvoy

Co-Founder, OnSend

A changing delivery landscape

The transport sector has challenges and opportunities never before seen. Increasing consumer demand for online shopping, accelerated by a global pandemic, has both strained existing transport infrastructure, and provided consumers with more service options and experiences when shopping online as the result of converging technologies. The speed and quality of delivery services continue to improve at pace and scale.

Population growth has combined with a lack of satisfactory public transport options to increasingly push roading infrastructure beyond the capacity it was designed for at a time when timely B2C service demand is growing with the surge in e-commerce freight volumes. What has worked for decades within the broader supply chain is no longer working as effectively has in the past due to very different operating environment, particularly relating to traffic congestion. Auckland is the second-worst city behind Sydney for congestion on its roads (TomTom Travel Index 2018), and 29% worse in 2018 than it was just a year earlier. According to Auckland Council an estimated $2B of lost productivity occurs due to traffic, which now accounts for 20 days per year for people living in Auckland.

Looking at New Zealand, expectations of population growth are startling. The ‘Golden Triangle’, which is situated in the North Island between Auckland, Hamilton, and Tauranga anticipates a 35% population growth over the next 25 years from 1.9M to 2.5M people. This region makes up half of the country’s population and most of the GDP. Growing demand for home deliveries combined with greater numbers of people on our roads, will combine in a perfect storm that traditional freight networks and distribution models were never designed for.

Online spending habits have been steadily changing over the years, which accelerated due to the behavioural shifts brought about by COVID-19. According to New Zealand Post research, during the first week of Level 3 lockdown, one dollar in every four was spent online. Many shoppers were forced online due to circumstance and for fear of contracting the COVID-19 virus beyond the safety of their homes. Certain parts of NZ that have been traditionally slower to adopt e-commerce saw a greater than 70% increase in online shopping (Taranaki, Northland, and Gisborne), with a nationwide increase in online shopping for the six months to June 30 of 30%. More than 170,000 adult New Zealanders shopped online for the first time in the first half of 2020. Adding to this, truck drivers are in a skills shortage, with an estimated 4,000 drivers immediately being required to meet pre-COVID demand levels.

The confluence of the move to online shopping, population growth, accelerated congestion on roads, and truck driver shortage demands a new approach to meet the needs of New Zealanders.

Consumer satisfaction

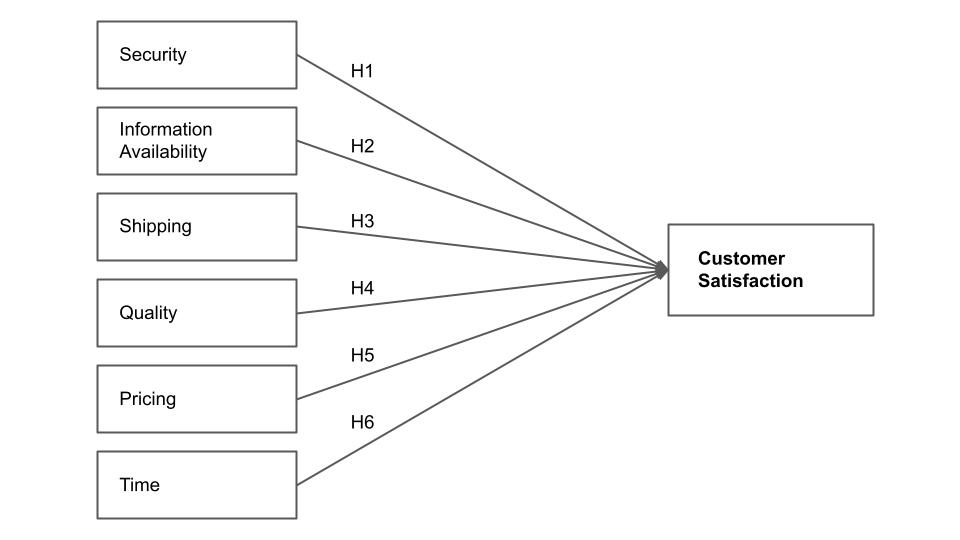

As consumers shop more and more online, they are increasingly able to compare the relative experiences they have with their online experiences. Delivery is a key factor in the online experience, along with others as seen below (Journal of theoretical and applied electronic commerce research, SciELO, 2019). Within shipping, reliable, secure, and fast shipments are strong positive contributors to overall customer satisfaction.

Underlying the time saving aspect in driving online commerce is the satisfaction in receiving something conveniently. Extended delivery time windows to weekends, evenings, and through secure drop-offs at click and collect locations, and inside customers’ garages and vehicles will all become expectations by 2025.

As noted by Yulia Vakulenko, Poja Shams, Daniel Hellström & Klas Hjort (2019) “Reliable delivery has been named as a source of customer value in e-commerce (Keeney 1999). Factors such as on-time delivery (Heim and Sinha 2001), price, and total delivery time (Swaminathan and Tayur 2003; Fisher, Gallino, and Xu 2016) have been accepted as antecedents to customer satisfaction and loyalty to an e-retailer. From the customer experience perspective, cognitive dissonance due to delivery delay impacts customers’ perceptions of the online shopping experience (Liao and Keng 2013).”

Carbon is coming

In 2016 the Paris Agreement was signed by 196 parties which foundationally sets long-term temperature targets and seeks to commit countries to determine, plan, and regularly report on the contributions they’re making to mitigating global warming.

Locally, New Zealand has a Zero Carbon Act which establishes a framework and commission to oversee a five-year budgeting process to drive the required emission reductions. Transport is the second largest source of emissions in New Zealand. As the main instrument to reduce greenhouse gas emissions is an Emissions Trading Scheme (NZ-ETS) (Ministry for the Environment, 2019b) we will see transport and agriculture go in the same direction as the forestry industry has done. The revised ETS introduces auctioning of New Zealand units (NZUs) to start in 2021, where bidders can bid for units. The revised ETS raises the carbon price from NZ$25 to NZ$35 to cover emissions in 2020 as a fixed price option, and prices are expected to reach NZ$54.12 by 2025 (Ministry for the Environment, 2020e). At these levels, the cost of not recognising emissions for the transport sector will become significant and very real.

For busy cities, transport presents as the largest contributor of greenhouse gases at 34.8% (Auckland Plan, 2016), and 6% of the nation’s entire emission profile. Within this diesel consumption has grown 22% (since 2007) compared to 2% for Petrol. The increase in diesel consumption has accounted for 89% of the rise in road transport emissions since 2007, and hence it takes little effort to understand that

On Dec 2, 2020 New Zealand declared a climate change emergency and committed to a carbon-neutral government by 2025, in what the prime minister Jacinda Ardern called “one of the greatest challenges of our time”.

Ultra efficient fulfilment

The transport sector faces numerous challenges as noted in this paper; increasing population, increasing traffic congestion, ever-increasing demand for delivered goods, a supply deficit of approximately 4,000 class 2 drivers (heavy vehicle operators), and looming carbon emissions policies that will increasingly hold the transport sector accountable financially to meeting environmental targets. It should be noted that emerging technologies allowing unmanned ground and air based delivery will be available in the coming future, however their penetration of the transport sector will be gradual and limited due to regulatory issues, requirements of intensification (for ground based solutions such as delivery robots with limited range to be viable) and as relates to weight constraints relative to consignment urgency (for early air solutions such as drones to be usable).

To meet the immediate challenges head on, existing infrastructure needs to be better utilised to present better outcomes to consumers, reducing carbon footprint, and changing the economics of operating existing larger road assets. This last point is crucial to advancing the timeframe of electrifying heavy fleet vehicles by making the move economically viable.

Freight businesses typically utilise hub and spoke network architectures. These involve having a large depot, usually at a city fringe location with access to road and rail. As freight businesses grow, they may have several large depots, but often they are separated for internal organisational reasons, and often located in close proximity to each other. As population growth drives transport congestion, these centralised depots have become ring-fenced by traffic congestion, decreasing the efficiency of a delivery fleet, increasing idle times along with cost, carbon impact, and reducing the reliability and predictability for the recipient of the service.

Just as server architecture has evolved from large singular mainframes to clusters of networked servers, to meet load and redundancy challenges, the arrangement of supply chain infrastructure must adapt to meet the evolving operating conditions and demands being placed on it. Reapproaching this, a technology-enabled platform could operate with ‘nodes’ which may be static structures or rolling structures, to cache freight efficiently on the other side of traffic congestion.Nodes are established through Machine Learning (ML) to analyse forecasted freight movements, and can exist either temporarily in an area or permanently. An example where a temporary node could be used is with trampolines across the Christmas season.

By operating nodes closer to the final delivery destination, arterial traffic is avoided. Smaller EV transport options are then available and utilised for high frequency, lower capacity delivery runs to local customers. This results in predictable and flexible delivery windows for customers, lowered carbon emissions, and the shortage of class 2 drivers is circumvented by utilising ubiquitous class 1 drivers in smaller vehicles (such as vans, and utes with trailers). Even smaller emerging vehicles for metropolitan delivery services are then possible with this network (such as arcimoto). Advanced automated storage and retrieval systems can be utilised at more permanent nodes for select SKUs (from companies such as Vanderlande).

Summary

It is clear that there are significant opportunities and challenges facing the transport sector. Population growth, the emergence of e-commerce changing old behaviours through a global pandemic, and constraints on infrastructure and workforce supply are all headwinds to an industry that requires new approaches to see continued success in the coming decade. At OnSend, we understand and have engineered solutions that retailers are today using to give their customers a continued excellent service beyond the purchasing experience. If you have a supply chain or logistics requirement and would like to know more about how OnSend can help, please get in touch.

Appendix

Journal of theoretical and applied electronic commerce research

https://scielo.conicyt.cl/scielo.php?script=sci_arttext&pid=S0718-18762019000200107

Yulia Vakulenko, Poja Shams, Daniel Hellström & Klas Hjort (2019) Online retail experience and customer satisfaction:

the mediating role of last mile delivery, The International Review of Retail, Distribution and Consumer Research, 29:3,

306-320, DOI: 10.1080/09593969.2019.1598466

Auckland Road Transport Emissions 2016

https://at.govt.nz/media/1980587/aucklands-road-transport-emissions-a-new-dialogue-final-may-2019.pdf

Older Posts

-

Introducing our new brand.

We’ve been working away to develop our brand to more accurately reflect the fast-paced nature of our business and technology, perfectly positioning us for future developments and growth.

9th December

-

A Review on COVID-19 and Supply Chain in New Zealand

A review of COVID-19 and the impact it has had on New Zealand supply chain sector and consumer behaviour.

9th June

-

Supply Chain Collaboration

Importance of soft skills - for great experiences at home, between business to drive amazing outcomes - supply chain is all collaborative.

29th July